Banks should carry out tighter checks and commission feasibility studies on developers’ proposed projects before deciding to grant financing, said property consulting firm Rahim & Co International Sdn Bhd.

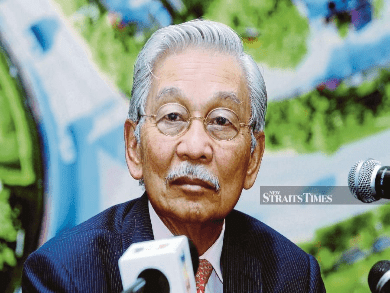

Rahim & Co executive chairman Tan Sri Dr Abdul Rahim Abdul Rahman said the studies should be looked into via the appointment of consultants to reduce units overhang in the market.

“Bankers cannot just lend money without considering developers’ situation. Will the properties be able to sell?

“The need of feasibility study should be there. It should be done independently and the best thing is for the lenders to conduct their own feasibility studies, rather than the developers go and do their study and reports,” said Rahim.