AS Malaysia is not in the property bubble territory, banks can help improve the market situation by lowering interest rates for housing loans, especially for first-time buyers.

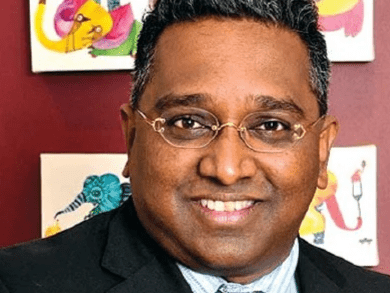

Lower interest rates may attract more buyers and this could ultimately reduce the current property oversupply in the country, said Previndran Singhe, the founder and chief executive officer of real estate firm Zerin Properties.

Data from the National Property Information Centre show that total value of overhang units in the market is RM19.54 billion, a 56.44 per cent jump from a year ago. If serviced apartments and small-offices-home-offices are included, the figure increases to 40,916 units, worth RM27.38 billion.

Overhang property refers to units that are completed but remain unsold nine months after obtaining certificates of fitness that signify they are fit for occupation.