Two mega rail projects laid the tracks of positive momentum for the construction sector as more clarity began to emerge on Malaysia’s mega infrastructure projects.

Following the confirmation that the once-shelved third MRT line (MRT3) is now a go, the government has also announced that the East Coast Rail Link (ECRL) will now be reverted back to its original alignment and is estimated to cost around RM50bil.

The reversal of the two decisions made by the predecessor of the current government breathed a new set of optimism into construction counters yesterday as it signified a possible increase in job awards locally, a long awaited catalyst by the market.

Since 2018, there has been a growing trend of construction firms aggressively seeking jobs overseas to diversify their earnings following the change of government that had led to reviews of mega projects to be rolled out.

On the latest developments for the ECRL, an equity analyst with a local research house said the realignment, coupled with the commitment for at least a 40% local participation for the construction and supply of building materials for the project, bode well for the local construction sector.

The project owner Malaysia Rail Link Sdn Bhd (MRL) and the main contractor for engineering, procurement, construction and commissioning (EPCC), China Communications Construction Company Ltd (CCCC) reached an agreement for this in January for the civil works, excluding tunelling works, then estimated to be up to RM10bil.

“With the MRT3 back on track and the latest ECRL 3.0 alignment, industry players are looking at brighter prospects ahead with opportunities to replenish their order books.

“We are also closely watching when the 12th Malaysian Plan will be tabled as it will give us a longer term view on the sector’s prospects, ” he said.

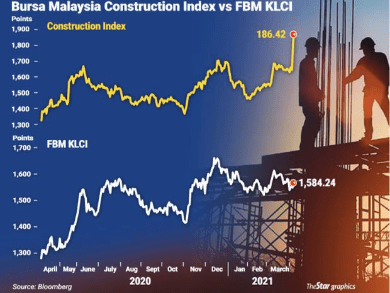

Investors reacted positively on Bursa Malaysia yesterday, which saw the Construction Index gaining 4.08 points or 2.24% to a three-week high of 186.42 points. The FBM KLCI fell by 0.07% points.

Out of the 51 constituents in the Construction index, 25 advanced while only nine declined.

Gabungan AQRS Bhd , which is involved in the subgrade, drainage and culvert works for the ECRL project in Pahang, led the gainers after adding 5.5 sen or 8.59% to 69.5 sen yesterday.

, which is involved in the subgrade, drainage and culvert works for the ECRL project in Pahang, led the gainers after adding 5.5 sen or 8.59% to 69.5 sen yesterday.

Bigger players like Gamuda Bhd rose 8 sen or 2.23% to RM3.66 while IJM Corp Bhd

rose 8 sen or 2.23% to RM3.66 while IJM Corp Bhd was up 7 sen or 4.12% to RM1.77.

was up 7 sen or 4.12% to RM1.77.

Public Investment Bank Research said the implementation of major infrastructure projects like the MRT 3 will boost the economy over the long-run, though also providing a near-term shot-in-the-arm for the construction sector.

Nonetheless, it maintained a neutral call on the sector, saying that the developments were already priced in.

It said the project will put MMC Gamuda in the limelight as the main proxy as it is the project delivery partner (PDP) for MRT1 and the turnkey contractor for MRT2, adding that it is also a strong contender for the underground portion given its expertise.

MMC Gamuda is the joint venture company between MMC Corporation Bhd and Gamuda.

and Gamuda.

Based on its rough estimates, CGS-CIMB Research said the revised MRT3 proposal may see cuts of 30% to 40% to the total original cost of RM45bil, bringing the total estimated revised cost to between RM27bil and RM32bil, due mainly to the reduction of certain underground scopes.

“The implementation of MRT 3 will be positive for rail contractors due to the potential larger-value packages.

“Using MRT2’s past contract awards as a gauge, MRT3’s contract packages could be subdivided into key scopes covering stations, viaducts, underground, depot and segmental box girders, among others, ” it said, adding that despite the reduction in underground alignment, it expected the MRT3 underground package to be the single largest scope for award.

While the Cabinet approval lifted the overhang on MRT3, CGS-CIMB said the speed of implementation, hinges on the finalisation of funding structure beyond the RM15bil direct allocation for new public transport projects under Budget 2021.

“Whether the new MRT3 comes with a private finance initiative (PFI) given the Government’s limited room for a direct infra funding model remains to be seen.

“Funding and political uncertainties aside, we are net positive on this news as construction newsflow on new mega contracts could pick up in the second half, ” it said, reiterating its “neutral” rating on the sector with diminishing political uncertainty and clarity on mega project funding as upside risks.

Upgrading its weighting for the sector from “underweight” to “neutral”, AmInvestment Bank Research believes investors were likely to react positively to the MRT3 approval given a news flow-driven, liquidity-fuelled and risk-on stock market.

Given the Government’s fiscal constraints, it felt that the implementation model of the project may gravitate towards a public-private partnership of which the main contractor may be required to take on certain operating or commercial risk and participate in the funding of the project, such as the ECRL and Island A of the Penang Transport Master Plan.

“The construction period may be prolonged to lighten the stress on the Government’s cash flow, meaning the earnings impact of the MRT3 project on construction companies may not be as significant as compared with the MRT1 and MRT2 that were fast tracked, ” it said.

Despite the positive development on the MRT3, UOB Kay Hian Research said a more concrete timeline of the project is needed before it imputes it into its valuation and recommendation.

“Given the Government’s financial position and political situation, the timeline of the project’s rollout could change.

“In the meantime, we prefer small and mid-cap construction companies with a good track record in clinching private jobs and laggards that are trading at an unjustifiable discounted valuation, ” it said.

How useful is this article to you?

Media Title: The Star

Date: 06 Apr 2021